All Categories

Featured

Table of Contents

The method has its very own benefits, yet it likewise has problems with high costs, complexity, and more, leading to it being considered as a scam by some. Unlimited banking is not the most effective plan if you require only the financial investment component. The boundless financial principle revolves around using entire life insurance coverage plans as a financial device.

A PUAR enables you to "overfund" your insurance coverage policy right as much as line of it ending up being a Changed Endowment Contract (MEC). When you use a PUAR, you rapidly enhance your money worth (and your death benefit), thereby enhancing the power of your "bank". Additionally, the even more money value you have, the better your interest and dividend repayments from your insurance policy business will certainly be.

With the surge of TikTok as an information-sharing platform, monetary suggestions and strategies have located an unique means of dispersing. One such strategy that has been making the rounds is the infinite banking idea, or IBC for short, amassing endorsements from celebs like rapper Waka Flocka Fire - Private banking strategies. Nevertheless, while the approach is presently popular, its origins map back to the 1980s when economic expert Nelson Nash introduced it to the globe.

How flexible is Cash Flow Banking compared to traditional banking?

Within these policies, the cash worth expands based on a rate established by the insurance firm. When a considerable cash money value collects, policyholders can obtain a money worth lending. These fundings vary from conventional ones, with life insurance policy serving as collateral, implying one might shed their coverage if loaning exceedingly without ample cash value to support the insurance policy expenses.

And while the attraction of these plans appears, there are natural constraints and risks, necessitating persistent cash money value tracking. The method's legitimacy isn't black and white. For high-net-worth individuals or local business owner, especially those making use of strategies like company-owned life insurance policy (COLI), the advantages of tax breaks and compound growth could be appealing.

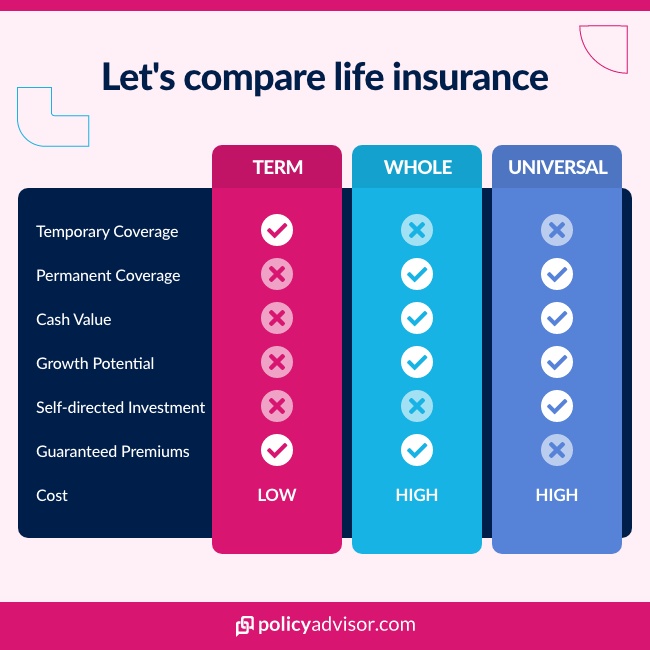

The allure of infinite banking does not negate its difficulties: Expense: The foundational need, an irreversible life insurance policy plan, is costlier than its term equivalents. Qualification: Not every person qualifies for whole life insurance because of extensive underwriting processes that can leave out those with certain health or lifestyle conditions. Complexity and threat: The detailed nature of IBC, paired with its risks, may prevent lots of, specifically when easier and less high-risk choices are offered.

Whole Life For Infinite Banking

Alloting around 10% of your regular monthly revenue to the policy is just not practical for a lot of people. Component of what you read below is merely a reiteration of what has already been claimed over.

Through the concept of Infinite Banking, policyholders can fund major investments without relying on traditional banks (how to use infinite banking to eliminate debt).

Insurance brokers specialize in helping clients choose the right policy for Infinite Banking. This approach is trusted by business owners looking to enhance cash flow and financial flexibility. Schedule a consultation with a broker to explore how Infinite Banking can work for you.

Before you obtain yourself right into a situation you're not prepared for, understand the following initially: Although the principle is typically marketed as such, you're not really taking a loan from yourself. If that were the situation, you would not need to repay it. Instead, you're obtaining from the insurer and have to settle it with rate of interest.

Some social networks posts advise utilizing cash money value from entire life insurance policy to pay down charge card financial obligation. The idea is that when you settle the funding with passion, the amount will be sent out back to your financial investments. However, that's not how it functions. When you pay back the loan, a part of that rate of interest goes to the insurance policy firm.

How do I optimize my cash flow with Infinite Wealth Strategy?

For the first numerous years, you'll be settling the commission. This makes it incredibly challenging for your policy to accumulate value throughout this moment. Entire life insurance policy expenses 5 to 15 times more than term insurance coverage. Many people just can't manage it. So, unless you can manage to pay a couple of to a number of hundred bucks for the following years or more, IBC will not benefit you.

Not everyone needs to count only on themselves for monetary safety and security. Leverage life insurance. If you call for life insurance policy, here are some beneficial tips to think about: Think about term life insurance policy. These plans give insurance coverage during years with substantial economic responsibilities, like home loans, trainee lendings, or when looking after children. See to it to look around for the finest price.

How do I leverage Infinite Banking Account Setup to grow my wealth?

Imagine never having to worry about financial institution car loans or high interest rates once more. That's the power of limitless financial life insurance.

There's no set lending term, and you have the liberty to select the repayment routine, which can be as leisurely as paying back the car loan at the time of death. This adaptability reaches the servicing of the financings, where you can choose for interest-only settlements, maintaining the loan equilibrium level and manageable.

What are the benefits of using Wealth Building With Infinite Banking for personal financing?

Holding money in an IUL fixed account being credited passion can typically be far better than holding the cash on down payment at a bank.: You've constantly dreamed of opening your very own pastry shop. You can borrow from your IUL plan to cover the initial expenditures of renting out a space, purchasing devices, and working with staff.

Individual finances can be obtained from traditional banks and lending institution. Here are some essential points to take into consideration. Charge card can offer an adaptable method to obtain cash for very temporary periods. Nevertheless, borrowing money on a bank card is normally very pricey with yearly percent prices of interest (APR) often reaching 20% to 30% or even more a year.

Latest Posts

Life Without The Bank & Becoming Your Own Banker

Infinite Banking – Becoming Your Own Banker

Nelson Nash Reviews